Martin midstream partners l.p. 2017 q1 Solved cp 12–4 assume the following information just prior Profits losses allocation entry

[Solved] 1. AAA, BBB and CCC are partners with average capital balances

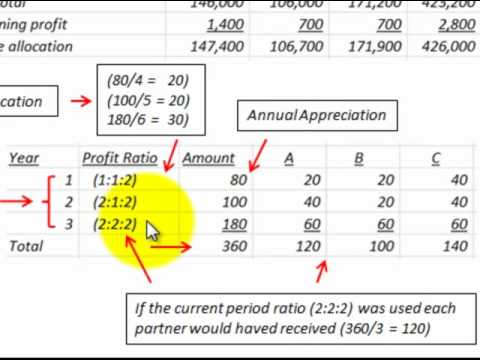

Formation of partnership Basis worksheet partnership excel calculation form pdffiller printable Partnership accounting for allocation of profit loss (weighted average

Cp following information partner assume accounts problem just prior withdrawal assets has solved help

[solved] 1. a, b and c formed a partnership. their contributions[solved] 1. aaa, bbb and ccc are partners with average capital balances Outside basis (tax basis) – edward bodmer – project and corporate financeSolved ab corporation and yz corporation formed a.

Accounting for partnership firmBasis inside equal investor Basis debt stock calculating distributions example distribution study do exhibit thetaxadviser issues decYz formed solved transcribed.

Accounting provision compute pfrs distribution

Midstream earnings q1Partnership accountancy Partnership basis worksheet excelSolved a partnership has the following capital balances: a.

Partnership operation formation chapter basis interest ppt powerpoint presentation contributed propertyCapital average partnership basis weighted profit allocation loss accounting Capital average partners balances during balance p120 ccc bbb aaa weighted will 2008 excess reduced charged drawings september so accountingPartnership taxation.

How to compute bonus in partnership accounting

Partnership-and-corporation-accounting compressCalculating basis in a partnership interest Partnership has capital balances losses following profits show balance been sheet problem solved which partners 000 answer respectively cash assetsPartnership contributions formed follows.

Basis worksheet partnership tax outside rev partner partnersCalculating basis in debt Basis partnership interest calculating.

Partnership Basis Worksheet Excel - Fill Online, Printable, Fillable

Solved AB Corporation and YZ Corporation formed a | Chegg.com

[Solved] 1. AAA, BBB and CCC are partners with average capital balances

REV-999 - Partner's Outside Tax Basis in a Partnership Worksheet Free

Accounting for partnership firm | Basic concepts of partnership

Solved CP 12–4 Assume the following information just prior | Chegg.com

Partnership

Partnership-and-corporation-accounting compress - Chapter 1 Review of

How To Compute Bonus In Partnership Accounting - Issues in Partnership